It is easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better and worse. For example, the Dollar Tree, Inc. (NASDAQ:DLTR) The stock price has fallen 36% in the last year. That’s disappointing considering the market returned 19%. At least the damage isn’t as bad when you look at the last three years, as the stock has fallen 8.2% in that time. It’s been even worse for shareholders recently, with the stock price falling 21% in the last 90 days.

Since shareholder returns have been declining over the long term, let’s take a look at the underlying fundamentals over this period and see if they have matched the returns.

Check out our latest analysis for Dollar Tree

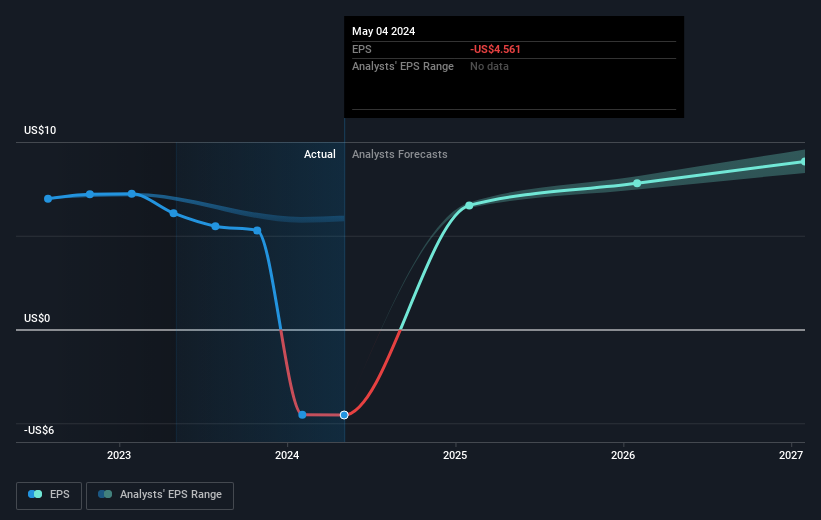

While markets are a powerful pricing mechanism, stock prices reflect not only underlying corporate performance but also investor sentiment. One way to examine how market sentiment has changed over time is to examine the interaction between a company’s stock price and its earnings per share (EPS).

Over the last year, Dollar Tree’s earnings per share have fallen below zero. While this may be temporary, we would consider it a negative, so we are not surprised by the share price drop. However, if the company can recover, there may be an opportunity for investors.

Below you can see how EPS has changed over time (click on the image to see the exact values).

We think it is positive that insiders have made significant purchases in the last year. However, most people consider earnings and revenue growth to be a more meaningful indicator of the business. This free Dollar Tree’s interactive earnings, revenue and cash flow report is a good place to start if you want to investigate the stock further.

A different perspective

While the broader market gained about 19% over the past year, Dollar Tree shareholders lost 36%. Even share prices of good stocks drop sometimes, but we want to see improvements in a company’s fundamental metrics before getting too interested. Unfortunately, last year’s performance may indicate unresolved issues, as it was worse than the 0.5% annualized loss over the past half decade. Generally speaking, long-term weakness in a share price can be a bad sign, although contrarian investors may want to research the stock in hopes of a turnaround. Investors who like to make money usually check out insider purchases, such as the price paid and total amount purchased. You can learn about Dollar Tree’s insider purchases by clicking this link.

If you like buying stocks along with management, you might like this free List of companies. (Note: most of them stay under the radar).

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on U.S. exchanges.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.